Charitable Lead Trust

A Charitable Lead Trust (CLT) is an irrevocable agreement in which a donor transfers assets to a trust that creates an income or lead interest for a charity. The trust’s remainder interest either comes back to the donor or passes to some other non-charitable beneficiary-typically the donor’s heirs. The charitable interest can be designated for the benefit of one or more charitable beneficiaries, including public charities, donor-advised funds and private foundations.

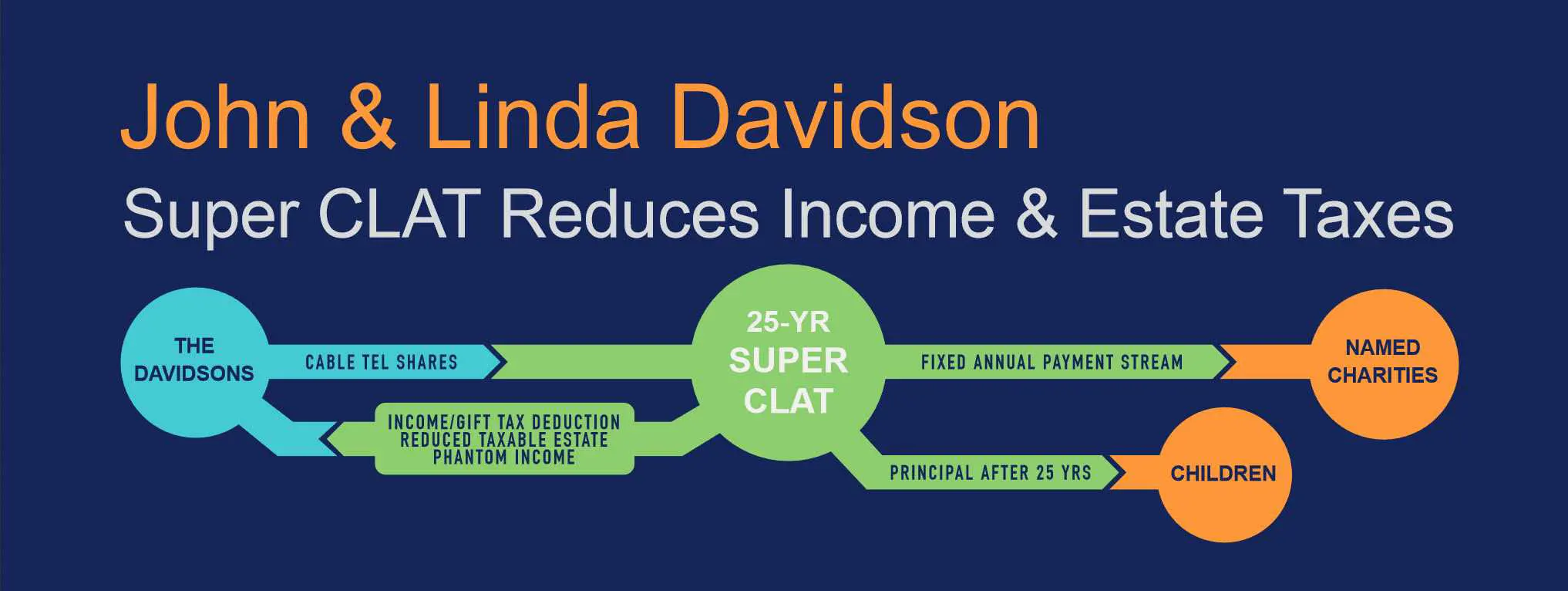

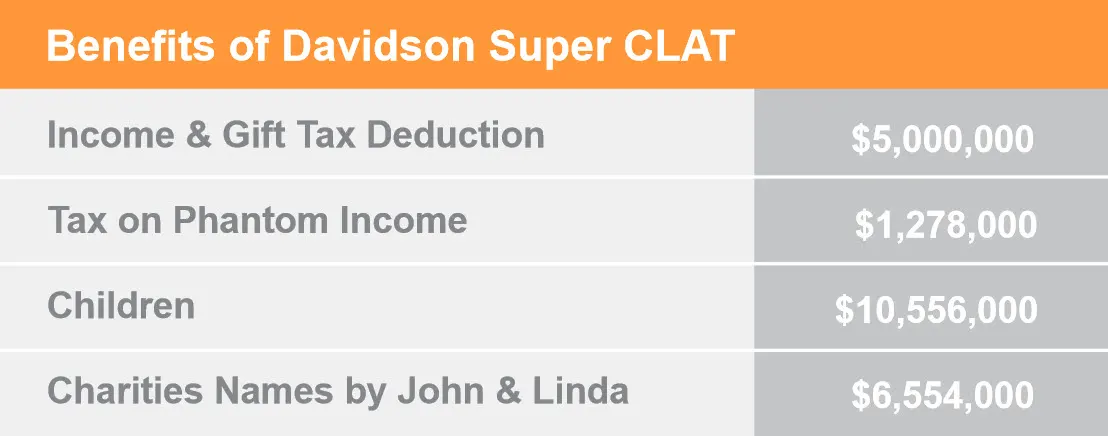

John Davidson is a long time employee of CableTel, a telecommunications company. Earlier this year, John and his wife, Linda, both age 60, exercised nonqualified stock options on Cable Tel valued at $5,000,000. With a $500,000 exercise price, their additional income tax from this transaction was $2,080,000 plus they added a $5,000,000 asset to their already taxable estate. In addition to their immediate income tax problem, John and Linda would like to set aside some money for their children as part of their estate planning goals.

Seeking a solution, John and Linda consult their financial planner. She advises transferring the CableTel shares to a super charitable lead annuity trust (”Super CLAT”) that pays a fixed annual amount to charities for a fixed number of years and then distributes all assets to their children. The Davidsons are delighted by the following Super CLAT benefits:

- John and Linda receive a substantial income tax charitable deduction, which will largely reduce the income tax due from exercising the option;

- The trust assets (including any growth in value during the fixed number of years) are not included in either John or Linda’s estate at their death; and

- Using this strategy, John and Linda set in motion a charitable giving program that supports their favorite causes with fixed annual payments.

Super CLT Basics

- Super CLTs are irrevocable trusts. The Donor’s family receives the assets of a Super CLT at the end of the charitable term.

- Super CLTs are taxed as a “grantor trust” for income tax purposes. Thus, a Donor who funds a Super CLT receives a one-time, current income tax charitable deduction.

- As a Grantor Trust, the Super CLT’s earnings are taxed to the Donor as “phantom income.”

- Super CLTs are a completed gift for gift tax purposes. The Donor receives a gift tax deduction for the charitable portion of the gift which can significantly reduce or eliminate the gift tax due on the value of the trust’s remainder interest given to children.

- Because the Super CLT is a completed gift, none of the trust assets (including any growth in value during the charitable term) is included in the Donor’s estate.

- The Donor gains satisfaction from supporting worthy causes with annual payments from the Super CLT.

Assumptions:

- CMFR = 2.2%

- CLAT payout rate = 5.2431%

- 2% dividend yield, 5% capital appreciation annually

- Combined Federal and state income tax rate = 46.23%

- Combined Federal and state dividend and capital gain tax rates = 27.61%

- CLAT investments monitored to minimize taxability of “Phantom Income”

This example is hypothetical and for educational use only. The situations, tax rates or return numbers do not represent any actual clients or investments. There is no assurance that the rates depicted can or will be achieved. Actual results will vary. Please consult with legal and tax counsel about the suitability.

Used with the express permission of RenPSG Inc.