Donor-Advised Fund

A Donor-Advised Fund (DAF) is very similar to a health savings account. Money is deposited into an account that can grow in value but instead of using the dollars to pay for health expenses, funds deposited into a DAF are granted out to charities. Donors make gifts directly to a sponsoring charity that maintains their DAF account, receive an immediate charitable deduction for their donations and then recommend the charities they want to receive grants.

In technical terms, each DAF is a segregated fund maintained by a qualified public charity which is created when a donor makes a gift of cash or assets. This gift allows the donor to receive an immediate income tax deduction, avoid the capital gains tax on appreciated assets and have the ability to make grant recommendations to charities at any time. The ability to make grant recommendations will continue for the life of the donor and then future generations can be appointed to make the recommendations for the rest of their lives.

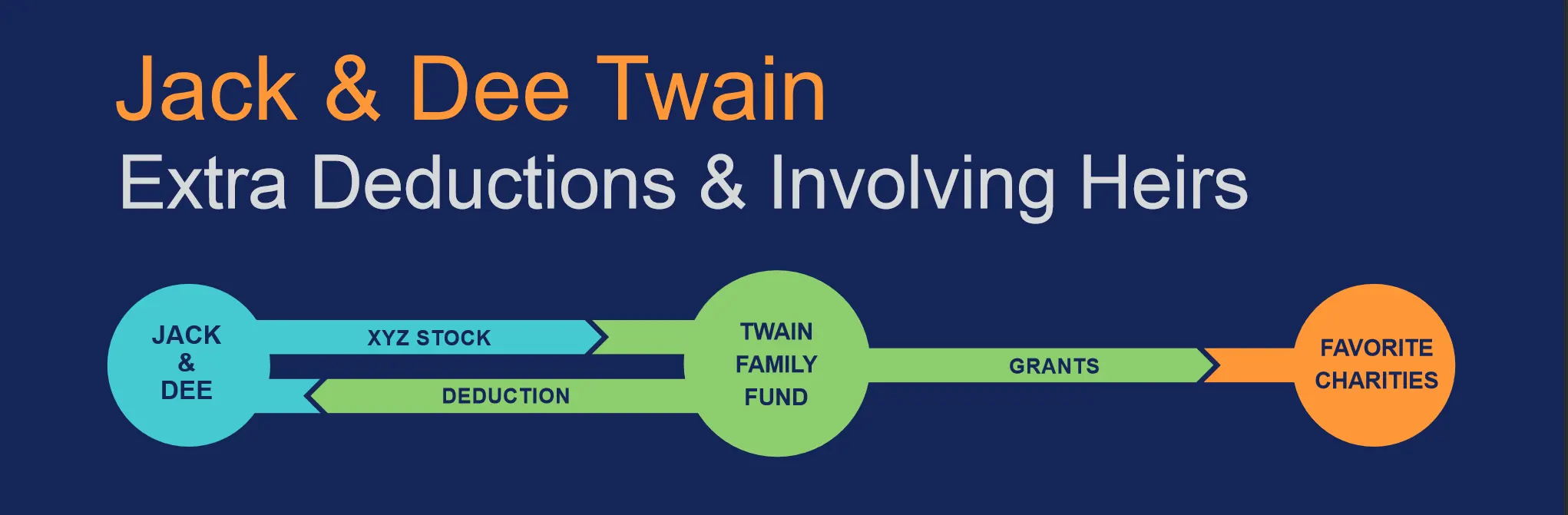

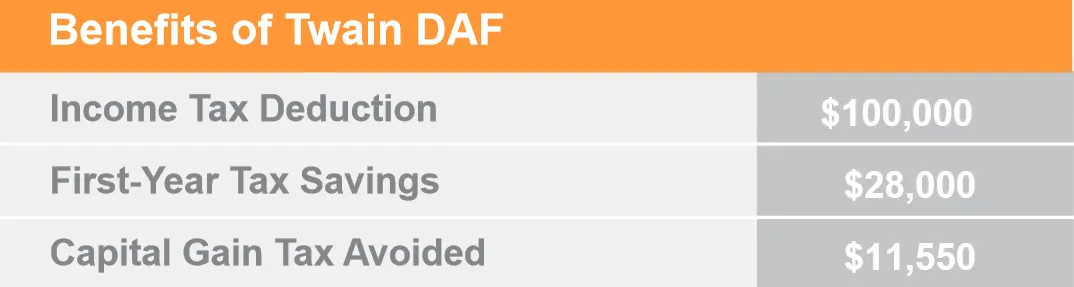

Jack and Dee Twain have made annual gifts totaling $5,000 to their church, their alma mater and the local symphony. With a combined income of $175,000, the Twains portfolio includes liquid investments valued at $2.5 million including $100,000 worth of XYZ stock that Dee purchased with a $40,000 inheritance several years ago. The Twains want to sell XYZ stock but don’t want to pay the $11,550 in capital gains tax.

The Twain’s financial advisor recommends creating a donor-advised fund to endow their annual giving. By transferring the XYZ stock to a donor-advised fund, they receive an immediate $100,000 income tax deduction, which reduces their tax burden by $28,000. Also, with all of their charitable giving coming from The Twain Family Foundation, they have freed up $5,000 of cash flow each year to use for other purposes.

After the stock transfer the stock is sold and the proceeds are reinvested in mutual funds or a variable annuity designed to produce an average yield of 6%. The financial advisor also recommends the Twains purchase additional investments with a portion of their tax savings and their previous checkbook giving of $5,000, and within a few years, the new investments may equal or exceed the $100,000 value of XYZ stock. Additionally, the Twains will have a higher cost basis in the new investments.

Assumptions:

- Deduction may be limited. Consult a taxadvisor.

- Marginal Federal and state income capital gain tax rate of 19.25%.

- For illustration purposes, the income taxburden reduction reflects the Twain’s Federalmarginal rate of 28% since many states donot permit itemized charitable deductions

Used with the express permission of RenPSG Inc.