Donor Story: Public Traded Stock

Mark and Kathy Parker, both 67 years of age, have been retired for two years. While they are living comfortably on their current retirement income, they are concerned about the effects of inflation on their purchasing power in the future. They would also like a little extra income for occasional trips and other modest luxuries they currently cannot afford. At the same time, the Parkers want to leave some inheritance for their children and grandchildren, as well as make a substantial gift to their local Jewish Federation which they have been involved with over the years.

The Parkers own $1 million worth of stock in the company where Mark worked for many years. As an employee of that company, Mark received stock options and exercised them over time and has a cost basis of only $100,000. The stock has been a very good growth stock, but has produced minimal dividend income. The Parkers considered selling some of the stock and reinvesting it in an income-producing portfolio, but they don’t like the idea of “donating” part of their gains to the Internal Revenue Service in the form of capital gain taxes.

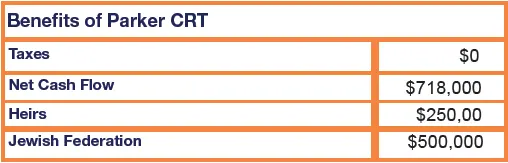

Fortunately, the Parkers’ advisor is familiar with charitable gift planning and proposes a solution to help them achieve all of their objectives and eliminate capital gain tax erosion. The Parkers give half of their stock to a charitable remainder trust (CRT) for which they can claim a $106,000 income tax deduction. The CRT sells that stock for $500,000, a savings of $87,000 in capital gain taxes. The sale proceeds are reinvested to provide a variable, supplemental income stream of approximately $40,000 each year before taxes. Some of that income is directed to a Wealth Replacement Trust to pay premiums on a policy that will benefit the Parkers’ children. At the Parkers’ death, the remaining assets in the CRT will be distributed to the Jewish Federation.

The $500,000 gift of stock to the CRT not only eliminated capital gain taxes the Parkers would have incurred with an outright sale, but it also created an income tax deduction that substantially improved their net cash flow. Additionally, the Parkers will create more lifetime spendable income, a larger inheritance for their children and a large to their favorite charity.

This example is hypothetical and for educational use only. The situations, tax rates or return numbers do not represent any actual clients or investments. There is no assurance that the rates depicted can or will be achieved. Actual results will vary.

Please consult with legal and tax counsel

about the suitability.

Assumptions:

- 2% dividend yield, 6% capital appreciation annually.

- Payout rate = 8%. CMFR = 3.0%. Deduction may be limited.

- Marginal Federal and state dividend and capital gain tax rates of 19.25%.

- Marginal Federal and state income tax rate of 38.25%.

- Federal Estate tax rate of 35%.

Used with the express permission of RenPSG Inc.