Charitable Remainder Trust

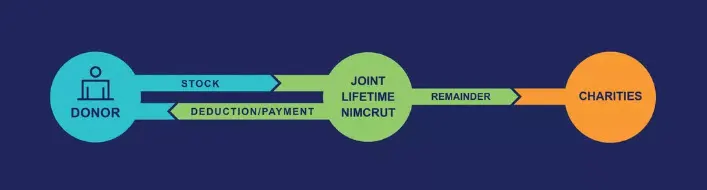

A Charitable Remainder Trust (CRT) is a tax-exempt trust that can liquidate an asset to create two interests: Income Interest, and Remainder Interest. The income interest is paid out to a designated beneficiary (such as the creator of the trust) for a lifetime or at the conclusion of the term, and the remainder interest is passed on to a qualified organization of the donor’s choice as specified in the trust document. Qualified organizations include charities, family foundations, donor advised funds, and others.

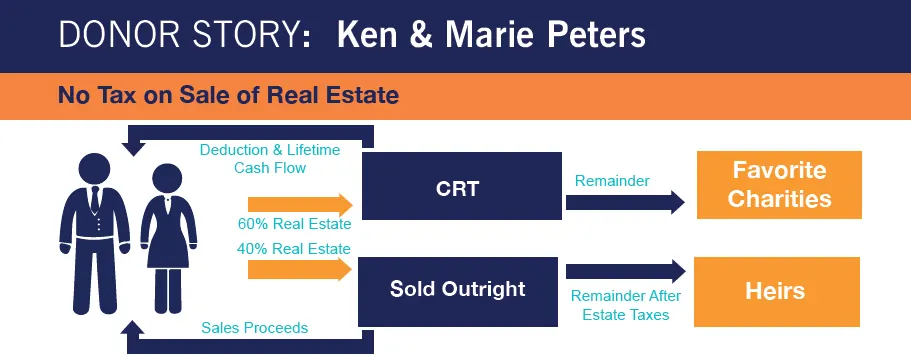

Ken and Marie Peters, both age 63, want to create an income stream for retirement, have enough funds to purchase a vacation home and reduce their responsibilities. To achieve their goals, they decide to sell a rental property they purchased 25 years ago for $150,000 which is now valued at $1,000,000.

While meeting with their financial planner, the Peters are surprised to learn they will pay more than $150,000 in capital gains tax when they sell the property. Their financial planner recommends contributing an undivided fractional interest in the real estate to a Charitable Remainder Trust (CRT) and selling the remaining portion outright. The portion contributed to the CRT will avoid all capital gains tax and produce a charitable deduction, which can be used to completely offset the capital gains tax paid on the portion sold outright.

The Peters contribute 60% of the property to a CRT and sell the remaining 40% outright for the following benefits:

-

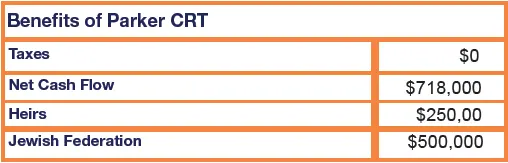

- Avoid $90,000 in capital gains tax through the CRT

- Create an income tax deduction of $184,000 for a first-year tax savings of $60,000

- Tax savings offset the $60,000 of capital gains tax from the 40% portion they sell outright

- Receive a lifetime cash flow of $1,475,000

- Contribute $961,000 to their favorite charities

- Establish an inheritance of $313,000 for their children

This example is hypothetical and for educational use only. The situations, tax rates or return numbers do not represent any actual clients or investments. There is no assurance that the rates depicted can or will be achieved. Actual results will vary.

Please consult with legal and tax counsel

about the suitability.

Assumptions:

- CMFR = 2.2%. Annual CRT payout = 5%. Investment Return of CRT = 7%.

- Marginal Federal and state capital gain tax rate = 19.25%.

- Estate tax rate = 40%. Ken & Marie’s typical AGI was $300,000.

- Ken and Marie can provide additional benefits to their heirs through life insurance or separate planning

- Assumes the property is not subject to a mortgage.

- Selling expenses are assumed to be 7% of the real estate value.

- The property in the CRT cannot be used by or sold to the Peters or their family.

- If the property was depreciable, capital gain tax may be higher.

Used with the express permission of RenPSG Inc.