Qualified Opportunity Zones

In 2017, the new tax bill created an incredible opportunity for tax-free investment. It permits investors to sell or exchange appreciated assets, invest the gain in just about any sort of venture within a geographically designated Qualified Opportunity Zone (QOZ), and receive substantial tax benefits as a result. The tax benefit comes in three pieces.

In 2017, the new tax bill created an incredible opportunity for tax-free investment. It permits investors to sell or exchange appreciated assets, invest the gain in just about any sort of venture within a geographically designated Qualified Opportunity Zone (QOZ), and receive substantial tax benefits as a result. The tax benefit comes in three pieces.

– First, deferral of taxes on the original gain: Any gain – of any character – recognized from the sale or exchange of appreciated assets can be “rolled over,” tax-free, into a QOZ business or fund, deferring until 2026 the tax that would otherwise be due on the gain. This is similar to the well-known 1031 like-kind exchange but much broader in its potential application because the requirements governing like-kind

exchanges do not apply to QOZ investments.

– Second, reduction of taxes on the original gain: In 2026, 85 percent of the rollover gains will be recognized,

and 15 percent generally will be tax-free.

– Third, and most significantly, permanent elimination of taxes on gain from the QOZ investment: Upon

disposition of a QOZ investment that has been held ten years or more, all gains will be permanently tax-free.

Time is of the essence to capture the tax savings. QOZ investments can be made starting this year, and an

investor only has six months to “roll over” a gain into a QOZ.

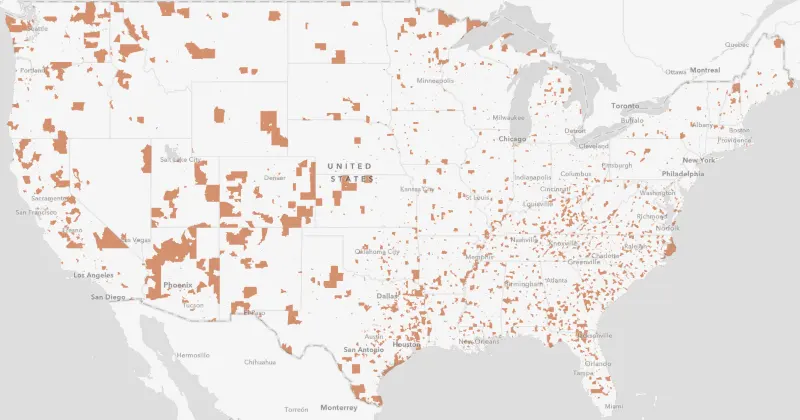

Qualifying investments must be made in the designated “zones,” which were historically lower-income areas.

But there are some significant up-and-coming urban business and residential areas that qualify, and many rural areas also qualify. Many sweet spots aren’t obvious. In Texas, much of downtown Houston qualifies, as does a swath of East Austin, downtown San Antonio, and many parts of downtown Dallas that are currently having a resurgence of real estate activity.

Which Businesses Could Qualify?

Several types of businesses potentially qualify as QOZ investments:

– Real estate development (office, warehouse, multi-family)

– New build

– Old construction with large renovations

– Manufacturing facilities

– Restaurants

– Car dealerships

– Oil and gas drilling or mining

– Service businesses with little tangible property outside the QOZ—licensing business, ad agencies

Key Aspects to Note

The original gain must result from a sale to an unrelated party.

During the 10-year holding period for the QOZ investment, taxes must be paid on the operating income of the QOZ business. This is a potentially great use of the new 21 percent C Corp. tax rates. Ninety percent of the QOZ assets must be tangible business property located in the QOZ.

Real property renovation investments must be big—essentially doubling the basis in that property—and have to be made within 30 months of initial purchase. As an example, this would include many multifamily developments in these zones.

Finance-driven businesses won’t qualify as a QOZ business (no more than 5 percent finance assets allowed, except for working capital).

A QOZ business cannot be recreational (golf, country club, massage, liquor stores).

Credit: This content was originally published by Brian Dethrow at Jackson Walker LLP